The Tax Cuts and Jobs Act of 2017

The official name of the new tax law is “An act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.” The unofficial name of the law is “The Tax Cuts and Jobs Act.”

The American Taxpayer Relief Act of 2012 and The Tax Relief, Unemployment Insurance Amortization, and Job Creation Act of 2010

The Tax Relief, Unemployment Insurance Amortization, and Job Creation Act of 2010 made major changes to the estate tax as well as the gift tax and generation-skipping transfer tax, although those changes are only in effect through December 31, 2012.

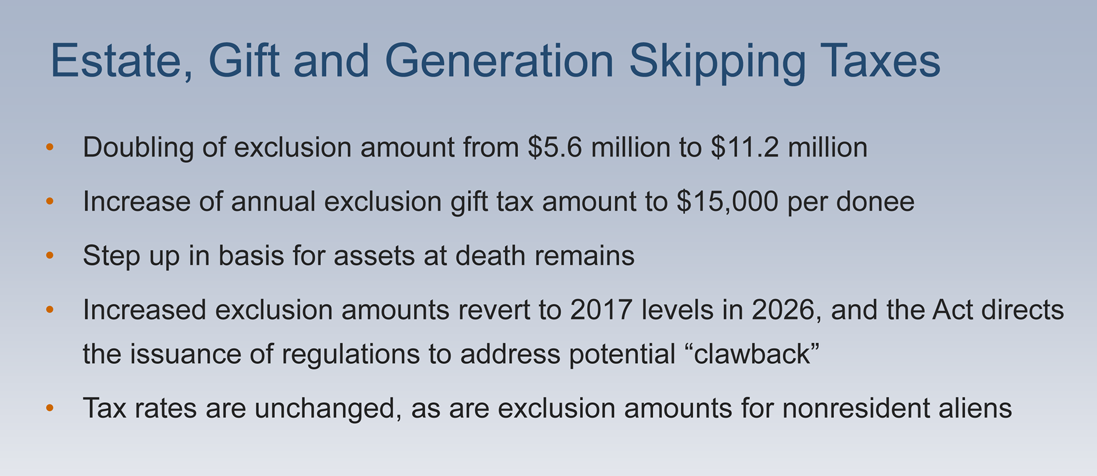

For estates of individuals dying after December 31, 2009, the maximum estate tax rate is 35% with an exclusion amount of $5 million. The exclusion amount will be adjusted for inflation in 2012. Inherited property will receive a stepped-up basis equal to the property’s fair market value on the date of the decedent’s death. The estate tax rate for 2013 and beyond will be 40%.

No changes are made to the annual gift tax exclusion. For 2011 the annual exclusion amount is $13,000, with married couples able to split their gift to make a combined gift of $26,000. For gifts made after 2010, the gift tax is reunified with the estate tax, providing a maximum gift tax rate of 35% and a maximum applicable exclusion amount of $5 million. For the very wealthy, one might make large gifts now and pay gift tax at the low 35% rate; and 40% in 2013 and beyond.

After 2010, the generation skipping tax rate is equal to the highest estate and gift tax rate in effect for that year, which would be 35% for 2011 and 2012, and 40% in 2013 and beyond.

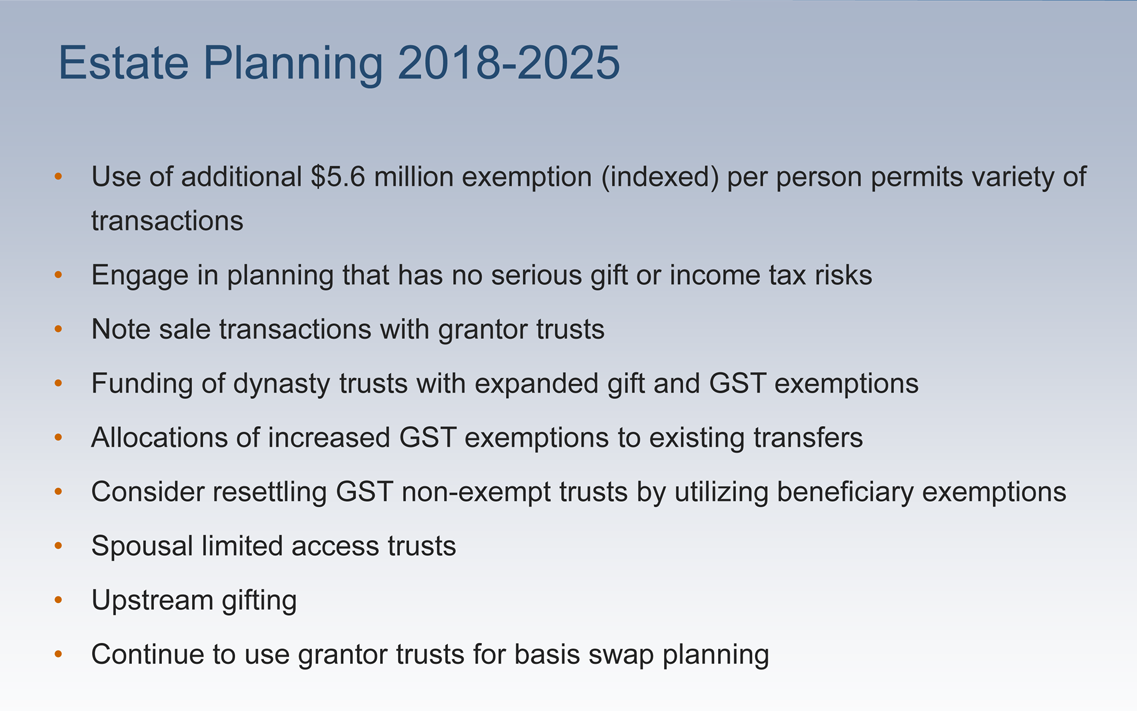

For the first time, the 2010 Tax Act introduces the concept of “portability” of the unused spouse’s estate tax exclusion. The 2012 Tax Act, signed by President Obama on January 2, 2013, made that concept permanent. The unused portion of the estate tax exclusion of a predeceased spouse can be used by the surviving spouse. To do so, the surviving spouse must make an election on a timely filed estate tax return. This additional exclusion can be used for taxable transfers during life or at death (but not for generation skipping). If the surviving spouse is predeceased by more than one spouse, the additional exclusion amount carried over to the surviving spouse is limited to the lesser of $5 million or the unused exclusion of the last deceased spouse. For instance, if one spouse dies and uses $3 million of his $5 million exclusion, his surviving spouse’s exclusion would equal $7 million (her $5 million exclusion plus her spouse’s unused $2 million exclusion).

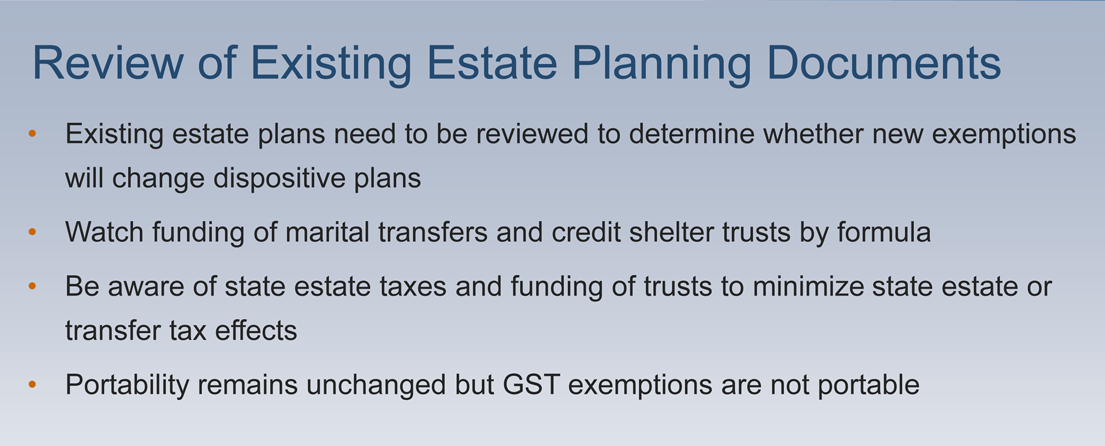

Thus, with careful planning, couples are able to avoid estate taxes on up to $10 million of property, without the need for trusts or other sophisticated estate planning vehicles. Many individuals may no longer need “estate tax avoidance” trusts in their planning. Prior to the 2010 Tax Act, relatively wealthy individuals needed to have such trusts in the Last Will and Testament of the first spouse to die. Now, many people should consider just leaving everything outright to one’s spouse. However, one should strongly consider the likelihood of the surviving spouse remarrying or simple giving assets to charity which would effectively disinherit the couple’s children. A trust could avoid all this.

Alan Rothschild, chairman of the American Bar Association Trust and Estate section put it this way: “Estate attorneys have hidden behind the estate tax to discuss leaving assets in trust to spouses. There are other less pleasant reasons to leave assets in trust, such as marriage and competency. Yet, without the specter of an estate tax, lawyers and accountants worry that people will not plan at all. They will leave what is known in the industry as ‘I love you’ wills, giving everything to the surviving spouse. In taking this path, though the wealthy lose control of how their estates will be distributed.”

How can you protect and preserve your wealth and legacy? One answer is by utilizing trusts and balancing control (the terms of your trust, your trustee selection and successor sequence) with flexibility and cost. Trusts can be revocable, irrevocable, contingent, or testamentary and involve securities, real estate, life insurance, retirement plan/IRA (Traditional or Roth) with disability, asset/creditor protection (spendthrift), educational, income and estate tax reduction, second marriage issues, attempted value incentives, special needs, generation skipping, and dynasty provisions. Did I say I like Trusts? The QTIP trust ensures passage to your children and not your spouse’s next family. An inter-vivos (living) QTIP trust enables either spouse to be deemed the owner of the QTIP trust and ensures maximum estate tax exclusion usage.

Source: Revenue Provisions Contained in an Amendment to H.R. 8, The “American Taxpayer Relief Act Of 2012,” As Passed by the Senate On January 1, 2013; see also AAPPT, LLC, Spring, 2013 Newsletter.

IN PARTICULAR, THE TAX ACTS OF 2010 AND 2017 ARE MILESTONES IN ESTATE TAX LEGISLATION. EACH YEAR THERE ARE SOME CHANGES.

New Georgia Trust Law

Recently, in an effort to “modernize” the Georgia law, the Trust Code Revision Committee of the Fiduciary Section of the Georgia Bar recommended and the General Assembly amended the Georgia Trust Code to expand the ways to modify otherwise irrevocable trusts to, among other things, (1) authorizing non-judicial (NO JUDGE involvement/discretion) modifications to trusts; (2) requiring courts to approve petitions to modify a trust where they are brought with the consent of the settlor (trust creator) and all beneficiaries; (3) permitting a Court to modify a trust to achieve the settlor’s tax objectives; and (4) authorizing the decanting of trust property to a new trust with different terms, even without the consent of the settlor or beneficiaries, so long as the new trust does not add beneficiaries who were not beneficiaries of the original trust. Trust terminations are also made less difficult.

Further, for those citizens interested in generational or generation skipping trusts, the Rule Against Perpetuities was amended from 90 to 360 year permissible vesting period. Accordingly, one might be less inclined to shift the situs(location/governing law) of one’s trust to another state.

New Georgia Trust Code (July 2010).

If you are the creator or trustee of a Georgia revocable trust or if your Will contains one or more trusts, you should be aware of two new duties that Georgia law imposes on trustees. Section 53-12-242 of the Official Code of Georgia (OCGA) imposes on the trustee a duty to inform certain “qualified beneficiaries” of the existence of the trust and the name and the mailing address of the trustee. OCGA § 53-12-243 imposes on the trustee a duty to provide reports and accounts upon reasonable request of such qualified beneficiaries; this duty also applies to Trustees of irrevocable trusts. Both of these duties can be waived by the individual who establishes a trust.

A modification of a trust that cannot be modified by its terms must be accomplished by the Court. The new Georgia statute drops the clear and convincing evidence threshold and shifts to beyond a preponderance standard and allows the Court to: 1) modify the administrative or dispositive provisions of a trust if, owing to circumstances not known to or anticipated by the settlor or testator. compliance with the provisions of the trust would defeat or substantially impair the accomplishment of the purposes of such trust; 2) modify the administrative provisions of a trust if continuation of the trust on its existing terms would impair such trust’s administration; or 3) modify the trust by the appointment of an additional trustee or special fiduciary if the Court considers the appointment necessary for the administration of the trust. In essence, it’s easier to modify an old trust now in Georgia.